Qualified dividends as defined by the United States Internal Revenue Code are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individuals ordinary income. Qualified Dividends and Capital Gain Tax Worksheet.

Qualified Dividends And Capital Gain Tax Worksheet

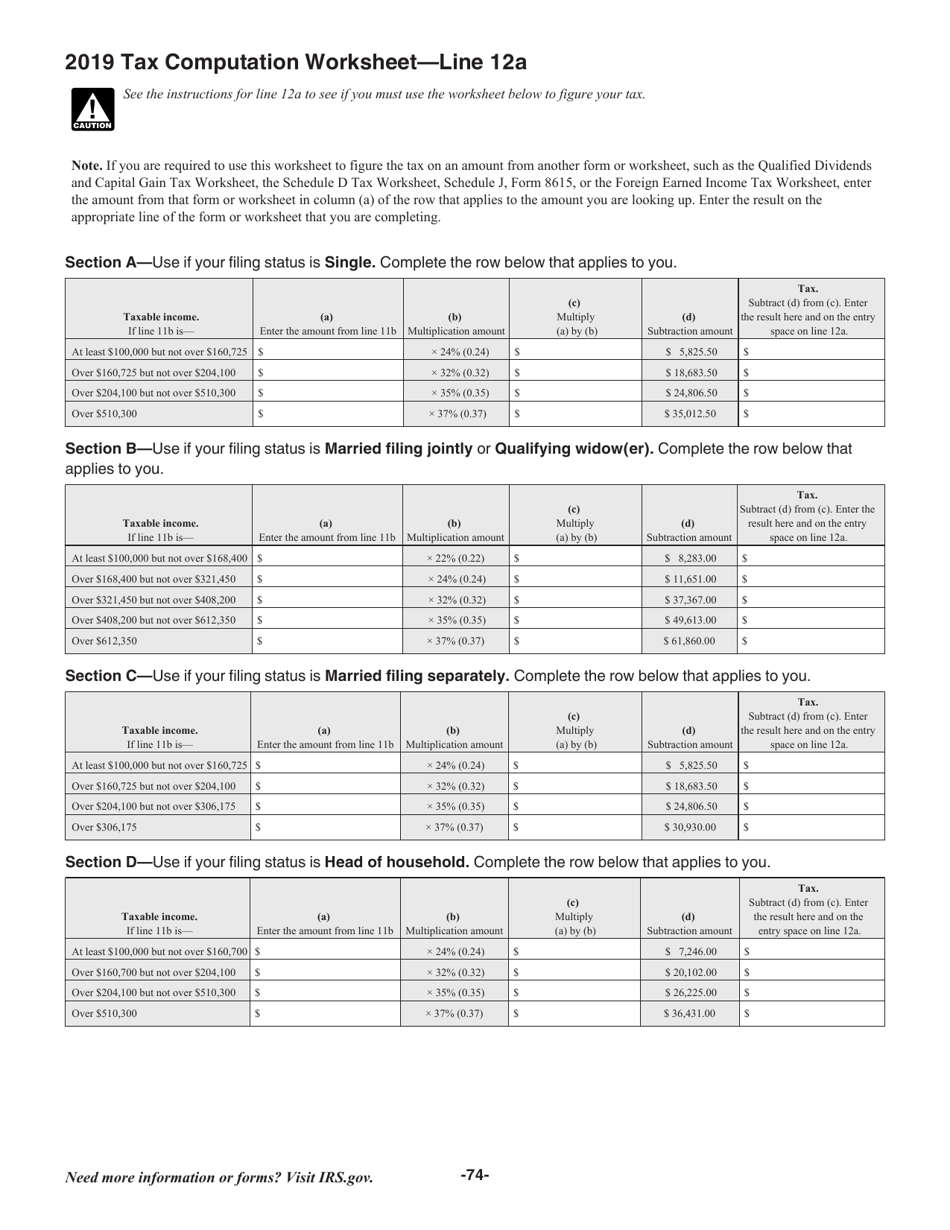

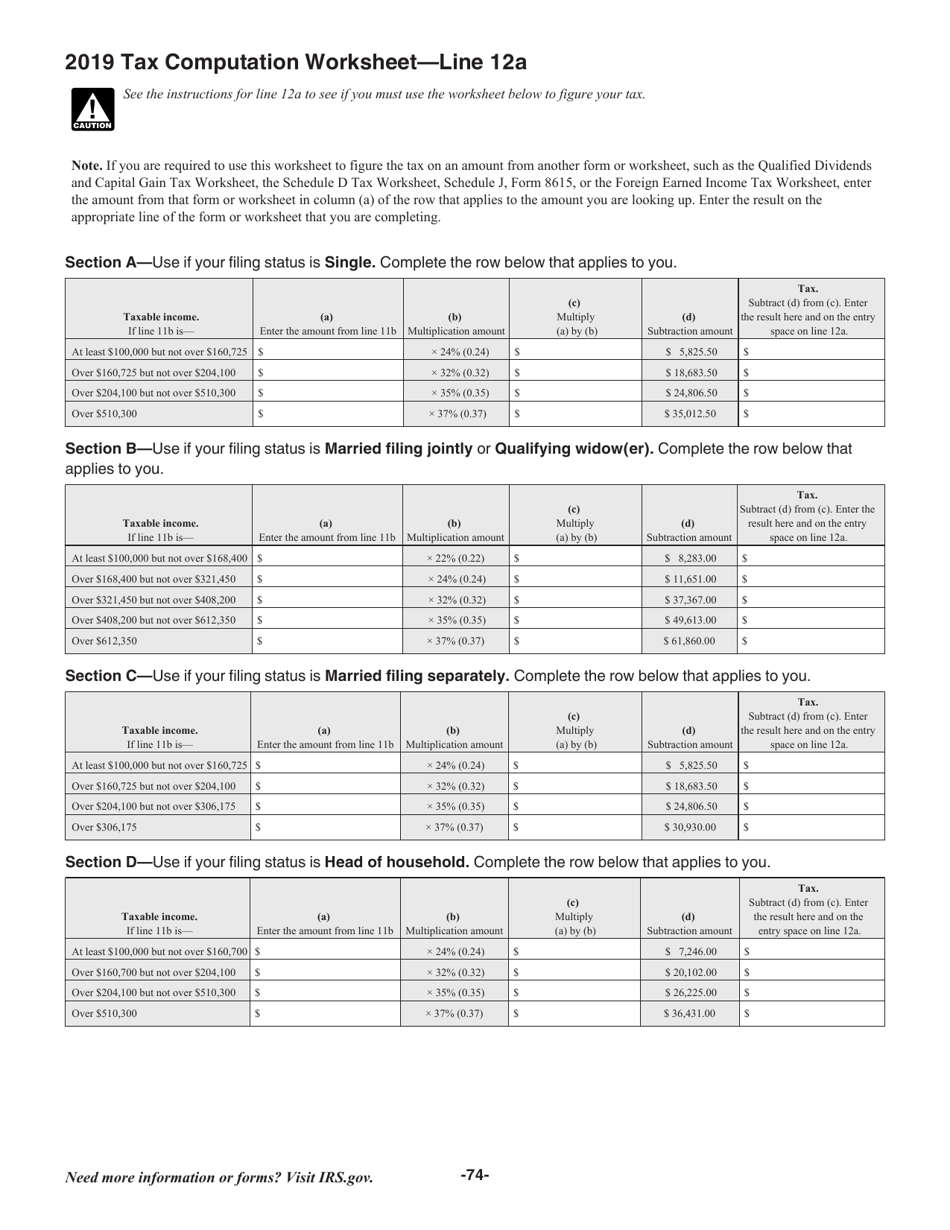

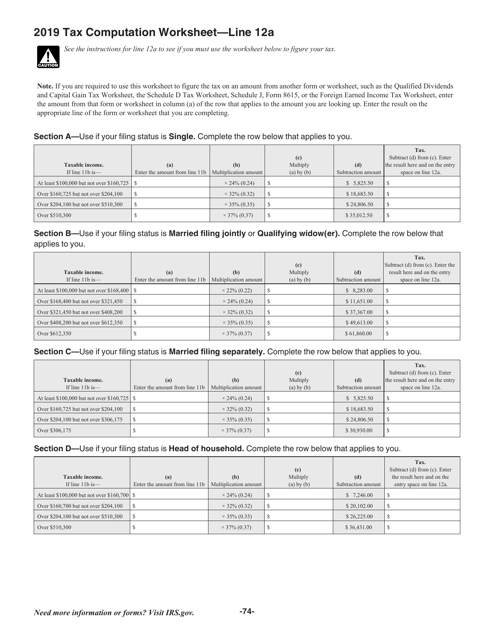

2019 Tax Computation WorksheetLine 12a k.

. Qualified Dividends and Capital Gain Tax WorksheetLine 11a. Capital gains tax worksheet calculator. In the instructions for Forms 1040 and 1040-SR line 12a or in.

Note that on the actual 1040 there is no indication that the worksheet has. To see this select Forms View then the DTaxWrk. The 0 rate applies to amounts up to 2650.

Click on column heading to sort the list. Qualified Dividends and Capital Gain Tax Worksheet 2019 See Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayers tax Before completing this worksheet complete Form 1040 through line 11b. As noted in my question the flaw occurs on line 18 where you subtract line 17 effectively taxable income that is not qualified dividends or capital gains from the 15.

Qualified dividends and capital gains worksheet 2021reate electronic signatures for signing a qualified dividends and capital gain tax worksheet 2020 in PDF format. Before completing this worksheet complete Form 1040 through line 10. Time to fill out.

If the taxpayer does not have to file Schedule D Form 1040 and received capital gain. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. If the taxpayer does not have to file Schedule D Form 1040 and received capital gain distributions.

If the taxpayer does not have to file Schedule D Form 1040 and received capital gain. You may be able to enter information on forms before saving or printing. I am attaching a hypothetical example of a completed worksheet.

If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends. If the taxpayer does not have to file Schedule D Form 1040 and received capital gain distributions. Unformatted text preview.

If there is an amount in box 2d in-clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses. All forms are printable and downloadable.

Qualified Dividends and Capital Gain Tax Worksheet 2018 Form 1040 instructions for line 11a to see if you can use this worksheet to figure your tax. 2019 Tax Computation WorksheetLine 12a. If you use the electronic template you can make capital gains tax worksheet on Microsoft Excel.

Line 12000 Taxable amount of dividends eligible and other than eligible from taxable Canadian corporations. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g even if you dont need to file Schedule D. Qualified Dividends and Capital Gain Tax Worksheet.

Qualified Dividends And Capital Gains Worksheet 2020. Qualified Dividends And Capital Gain Tax Worksheet 2019 Irs. Qualified Dividends and Capital Gain Tax Worksheet 2019 See Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayers tax Before completing this worksheet complete Form 1040 through line 11b.

I am attaching a hypothetical example of a completed worksheet. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet such as the Qualified Dividends and Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form 8615 or the Foreign Earned Income Tax Worksheet enter. Click on the product number in each row to viewdownload.

Fill Online Printable Fillable Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET HRblock Form. The 0 and 15 rates continue to apply to amounts below certain threshold amounts. Enter the amount from Form 1040 line 43.

Then use qualified without the quotes to search for the qualified dividends and capital gains worksheet. Capital gains and qualified dividends. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet.

If you entered the qualified dividends correctly select print select tax return all calculation worksheets select save as pdf. Once completed you can sign your fillable form or send for signing. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and.

Complete Edit or Print Tax Forms Instantly. And Capital Gain Tax Worksheet the Schedule D Tax Worksheet Schedule J Form 8615 or the Foreign Earned Income Tax Worksheet enter. Unformatted text preview.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf. Qualified Dividends and Capital Gain Tax Worksheet 2019 See Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayers tax Before completing this worksheet complete Form 1040 through line 11b. Use Fill to complete blank online HRBLOCK pdf forms for free.

SignNow has paid close attention to iOS users and developed an application just for them. For tax year 2019 the 20 rate applies to amounts above 12950. Ad Access IRS Tax Forms.

Names shown on return. In the instructions for Forms 1040 and 1040-SR line 12a or in the instructions for Form 1040-NR line 42. An Alternative to Schedule D.

Keep for Your Records. Qualified Dividends and Capital Gain Tax Worksheet 2019 See Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayers tax Before completing this worksheet complete Form 1040 through line 11b. Exclusion of Gain on Qualified Small Business QSB Stock later.

Even though the full amount shows up in the total income on the 1040 line 6 from Schedule 1 line 13 if you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from schedule D. What is a qualified dividend tax. The maximum tax rate for long-term capital gains and qualified dividends is 20.

To find it go to the AppStore and type signNow in the search field. If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-. The rates on qualified dividends range from 0 to 238.

This is not just a problem with Turbotax the flawed logic is in the IRS worksheet included in the 1040 instructions. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Instructions for Schedule D Form 1041 Capital Gains and Losses.

Qualified dividends and capital gain tax worksheet fillable 2020 qualified dividends and capital gain tax worksheet 2019 2020 qualified dividends and capital gains worksheet qualified dividend and capital gain worksheet 2019.

Pdf Qualified Dividends And Capital Gain Tax Worksheet Line 11a

Irs Form 1040 Download Printable Pdf Or Fill Online Line 12a Tax Computation Worksheet 2019 Templateroller

Qualified Dividends And Capital Gain Tax Worksheet 2021 Fill Out And Sign Printable Pdf Template Signnow

Qualified Dividends And Capital Gain Tax Worksheet

Irs Form 1040 Download Printable Pdf Or Fill Online Line 12a Tax Computation Worksheet 2019 Templateroller

2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Qualified Dividends And Capital Gain Tax Worksheet Fill Online Printable Fillable Blank Pdffiller

2018 Instruction 1040 Pdf 2018 Form 1040 U2014line 11a Qualified Dividends And Capital Gain Tax Worksheet U2014line 11a Keep For Your Records Before You Course Hero

Qualified Dividends And Capital Gain Tax Worksheet

2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

2014 Child Tax Credit Worksheet Fill Online Printable Fillable Blank Pdffiller

Qualified Dividends And Capital Gain Tax Worksheet

2018 Qualified Dividends And Capital Gain Tax Worksheet Pdf Qualified Dividends And Capital Gain Tax Worksheet 2018 U2022 See Form 1040 Instructions For Course Hero

2018 Instruction 1040 Pdf 2018 Form 1040 U2014line 11a Qualified Dividends And Capital Gain Tax Worksheet U2014line 11a Keep For Your Records Before You Course Hero

Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends And Capital Gain Tax Worksheet Fill Online Printable Fillable Blank Pdffiller

ConversionConversion EmoticonEmoticon